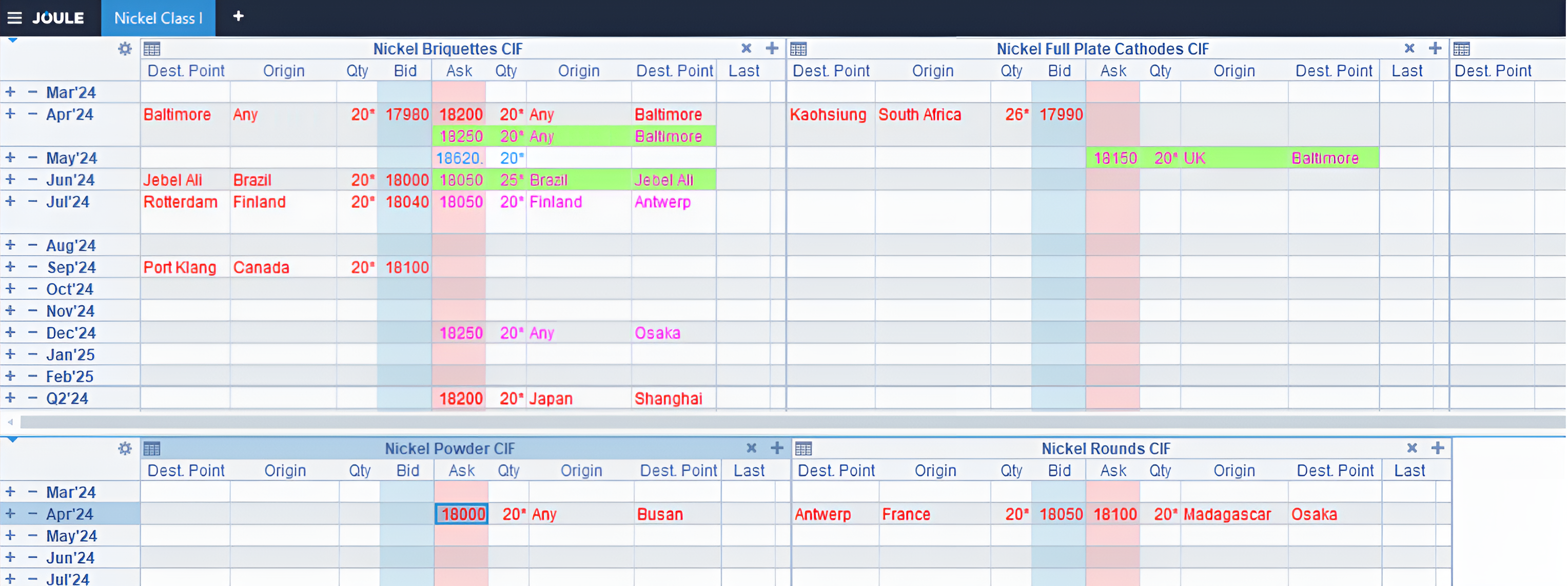

The GCHL trading platform provides quick, efficient access to standardised physical nickel contracts

Only principal companies, who will make or take delivery of the metal are permissioned to transact on screen.

Only qualifying screen bids, offers and trades will be included in the index calculations.

product specs

delivery T&Cs

credit between

counterparties

posted anonymously on screen

executed on screen

revealed to each other

communicated to the market

included in index calculations

All market participants create and maintain a list of counterparties with whom they can trade. Permissions can be conditional (e.g. buy only, sell only) or time-bound (limited to certain periods along the forward curve).

We'll show you the bids and offers of counterparties with whom you can trade in the red. Those of other parties will be in pink, and won't be executable.

The GCHL trading platform provides quick, efficient access to standardised physical nickel contracts

Price, destination, origin and volume are communicated in real-time to all market members, providing unparalleled insight into live physical market conditions

To reflect market needs, Members are invited to take part in the revision process for our Standard Trading Agreement for Metals, STA-M

Indices are calculated from actual bids, offers and trades posted on the trading screen. By actively participating on the market, you play a part in determining index prices